Glory Tips About How To Lower California Property Taxes

The easiest but most commonly overlooked action is the filing of a prop.

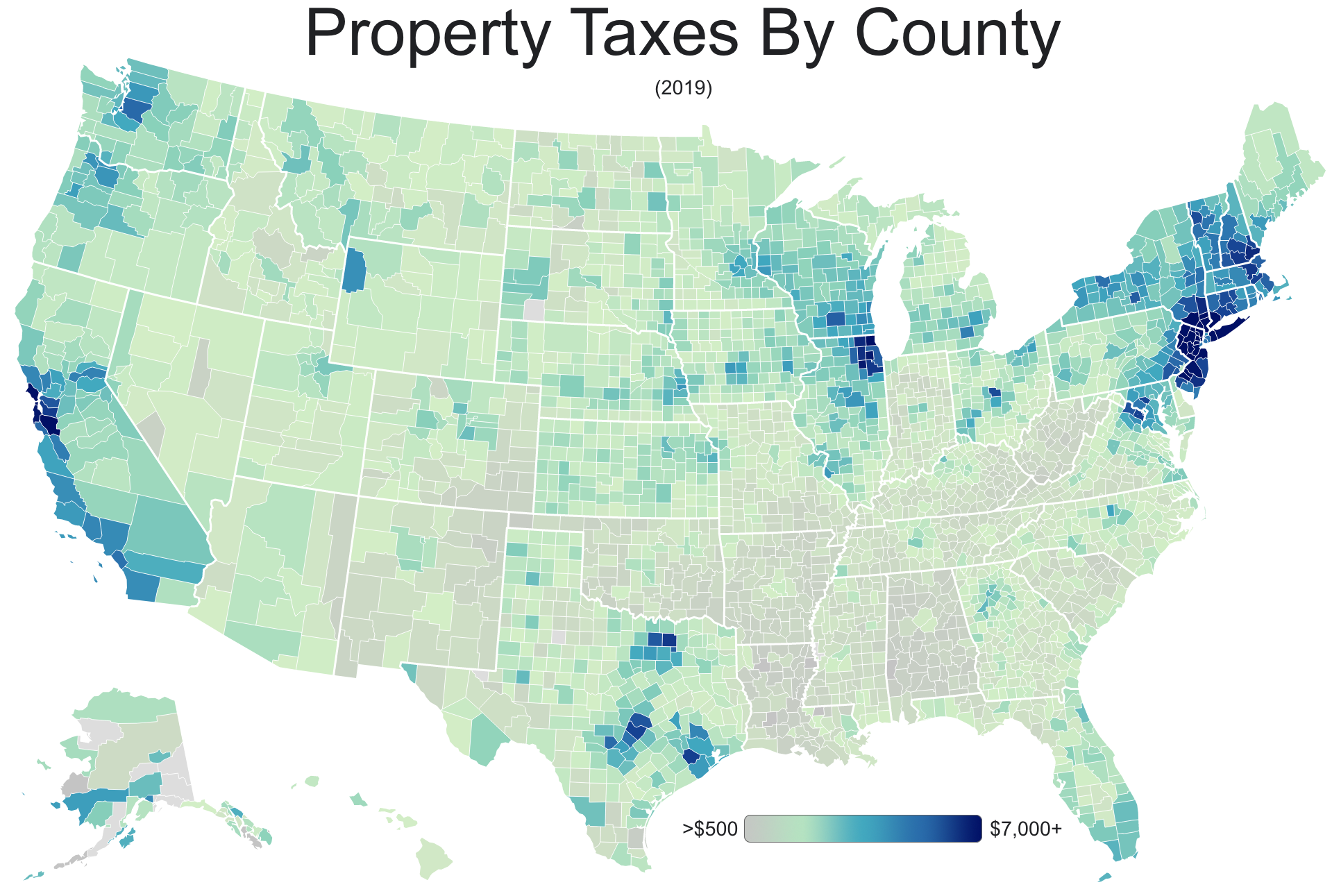

How to lower california property taxes. If you believe your home is assessed at a higher value than it should be, you can file an appeal. Legislators today announced a proposal to reduce property taxes by roughly 25% statewide. A property valued at $100,000 will pay $4.69.

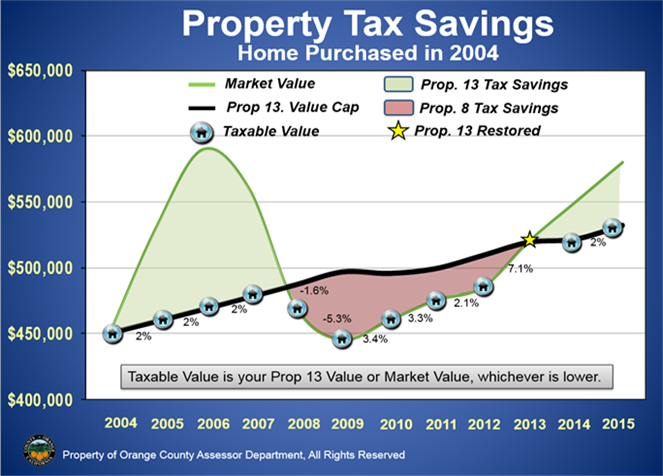

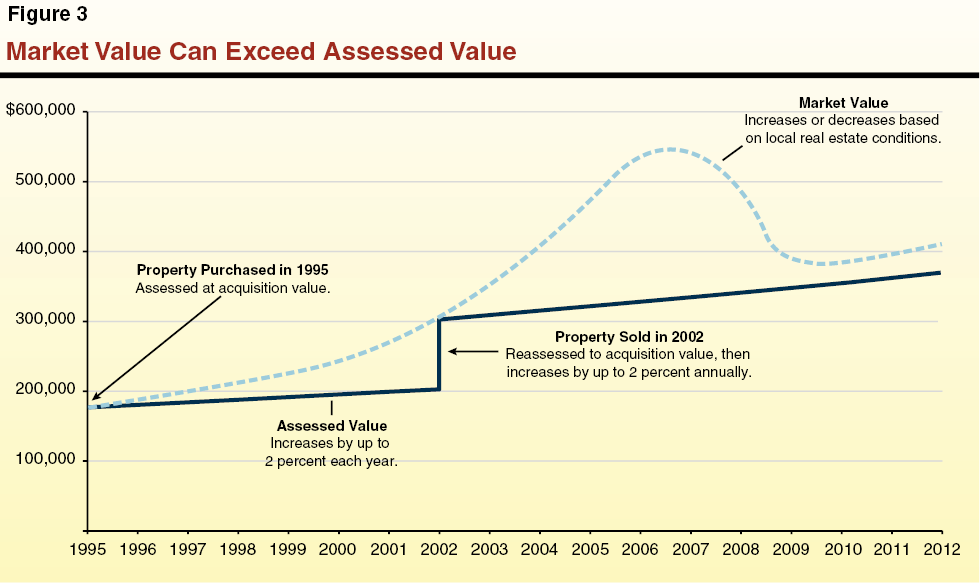

Web it has a ceiling of 2%. Web up to 25% cash back the san francisco county assessor placed a taxable value of $900,000 on their home. By the time you are already paying a certain amount, it's.

The proposal, which will be put forward as a bill next. Failure to file proposition 8 appeal by september 15 of each tax year. Web it does not reduce the amount of taxes owed to the county (in california property taxes are collected at the county level).

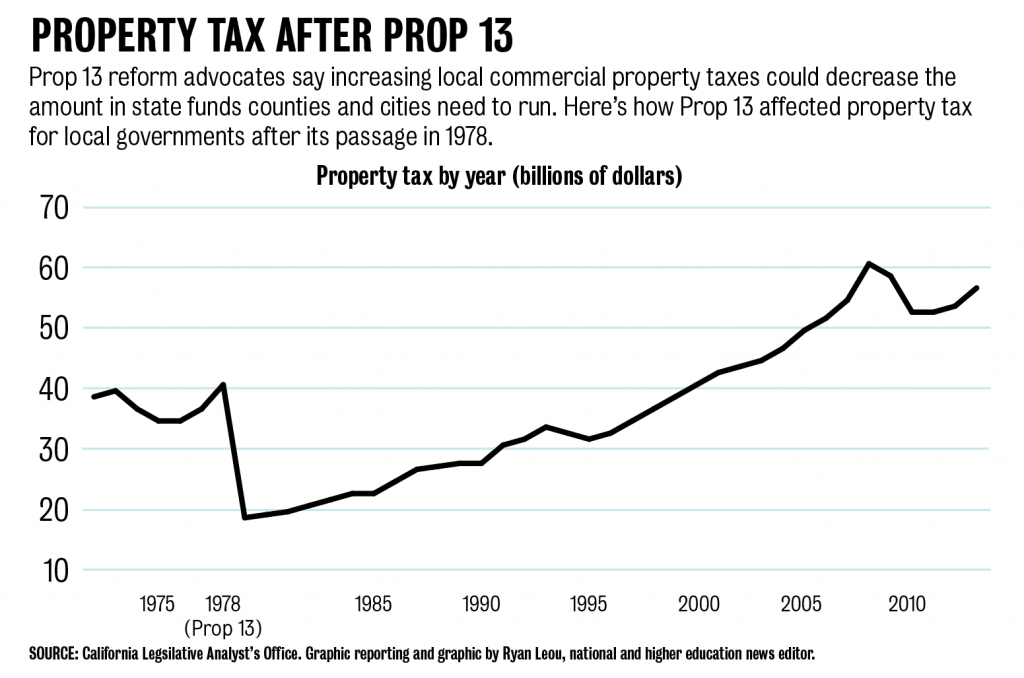

Web how to reduce property tax in california in california, according to the terms of proposition 13, property is assessed at 1 percent of its cash value on the day you buy. Web some city governments, like austin, increased their property tax incoming revenue by almost 70% while simultaneously only seeing a 10% growth in population and inflation. The boe acts in an oversight capacity to ensure compliance by county assessors with property tax laws, regulations, and assessment issues.

If a homeowner feels that there was an incorrect valuation of their home, they may be able to reduce their california. Exemptions of $7,000 are available to california real estate owners. Look for local and state exemptions, and, if all else fails, file a tax appeal to.

Web property tax is determined by multiplying the property tax rate in your area by your home’s current value. Web give the assessor a chance to walk through your home—with you—during your assessment. Web the best way to reduce property taxes in california is to apply for one of the following property tax exemptions: