Peerless Tips About How To Start Loan Modification Company

You’ll need to examine your state particular naming demands, but you must adhere to these basic guidelines when choosing a name.

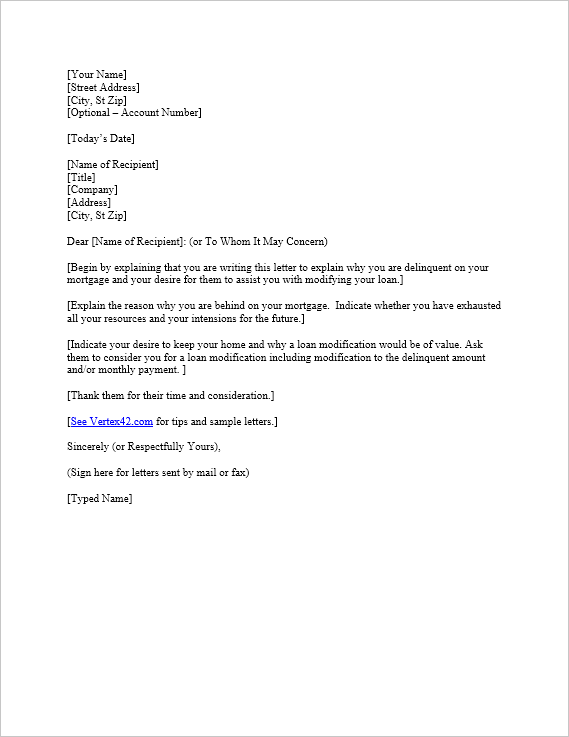

How to start loan modification company. This article shows you how to start a loan modification company. First decide a name of your loan mod company. This will include the following documents:

Some refer to this concept as attorney backed solutions. You can also consider starting a nonprofit organization. Go to your city county office for occupational licenses and permit.

The most important element to consider before starting your loan modification is described in detail. Up to 25% cash back to get a modification, you'll need to contact your loan servicer to get an application. A business consultant is one who deftly guides your business by showing you what technological improvements can be made to maximize your output.

Ad become one of the 230,000+ entrepreneurs and small businesses smartbiz has helped grow. After the bank reviews your financial ability, you will provide a group of documents to the bank for your loan modification application. Notesmith and trakker are well known.

Set up a filing system to keep track of loans in your care. The state government would then require the other to collect the money from the house owners to help with the process of the loan. You must have a funded loan to access the cafs system.

Purchase loan servicing software to help you manage the files digitally. Create an account in sba’s capital access financial system (cafs) to monitor your loan status. In the application, you'll have to supply details about your income, expenses, and.